The need for reliable and accurate forecasting is undeniable. Business and Real Estate values are fundamentally based on the present value of the future benefits of those investments. Additionally, the management of a business requires advanced planning to anticipate economic events and trends and to take advantage of opportunities as they may arise. Lead times may be short, as in the case of anticipating quarterly sales; or long, as in the case of planning for a major capital expenditure or for strategic long range planning three to five years ahead. Consequently, forecasting is an integral component for accurate valuation and effective planning.

The evolution of scientific and mathematical forecasting techniques has advanced considerably over the past 50 years. Various forecasting techniques have been developed to more accurately predict and plan for a wider variety of events. Knowledge of the strengths and weaknesses of these various forecasting techniques, which may apply to any given situation, is essential to creating accurate and reliable forecasts. One cannot simply rely upon “seat of the pants” planning if one is to be consistently successful in managing one’s investments or in determining the value of those investments and businesses.

Unfortunately, the vast majority of appraisers and CPA/appraisers are completely uneducated in these various forecasting techniques. They rely principally on naïve “seat of the pants”, judgmental, subjective, forecasting methods, which by their nature are prone to extreme bias and unreliability. It is not uncommon to then find that these appraisers and CPA/appraisers attempt to obfuscate their bias by puffing up and asserting that the mere existence of their superficial credential mitigates their bias. Once again, this sort of hyperbole is viewed with extreme skepticism by the courts, and should likewise be viewed with equal skepticism by attorneys and business owners. The unreliability of subjective forecasting methods is also one of the principal reasons why jurists often exclude forecast testimony as mere speculation.

In depth knowledge of and experience with these various forecasting techniques, their strengths and weakness, is required to both correctly choose among them and effectively apply them to a specific valuation or managerial problem or legal controversy. Accredited Business Appraisals has this knowledge, gained through years of experience and practical application to numerous real world situations.

Among the various techniques which Accredited Business Appraisals considers and selects from for a specific forecasting and valuation problem are:

- Identification of uncontrollable external events from controllable internal events.

- Potential application of qualitative methods including

- Jury of Executive Opinions,

- Delphi Method,

- Sales Force Method.

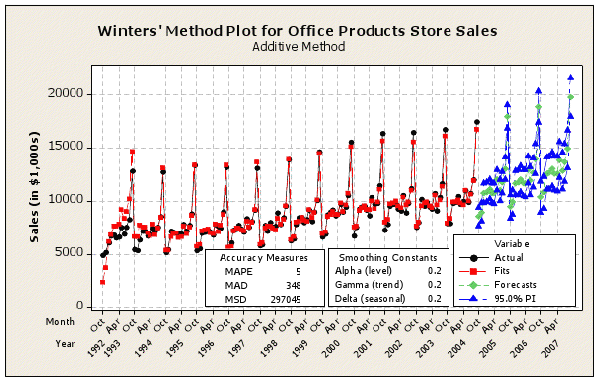

- Time Series Smoothing Techniques

- Simple Moving Averages,

- Weighted Moving Averages,

- Single Exponential Smoothing,

- Holt-Winters Exponential Smoothing.

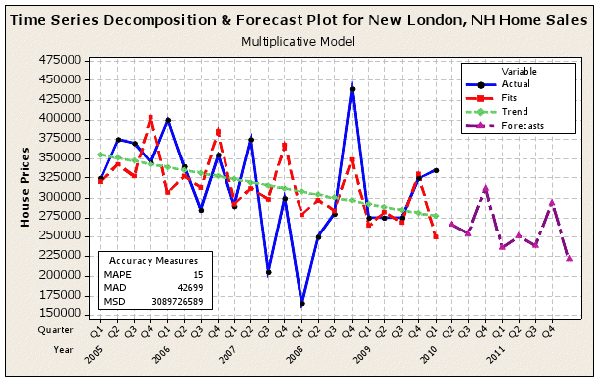

- Classical Decomposition

- Cyclical identification,

- Trend identification,

- Seasonal identification,

- Random or Noise identification.

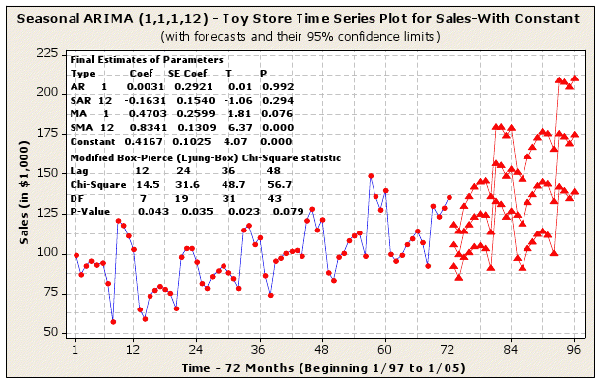

- Stochastic Modeling

- Autoregressive Methods,

- Autoregressive Moving Average Methods – ARMA,

- Box-Jenkins ARIMA Models,

- Univariate, Multivariate and Transfer Function Models.

- Model Selection Analysis – Application & Interpretation of:

- Akaike Information Criterion

- Schwartz Bayesian Criterion

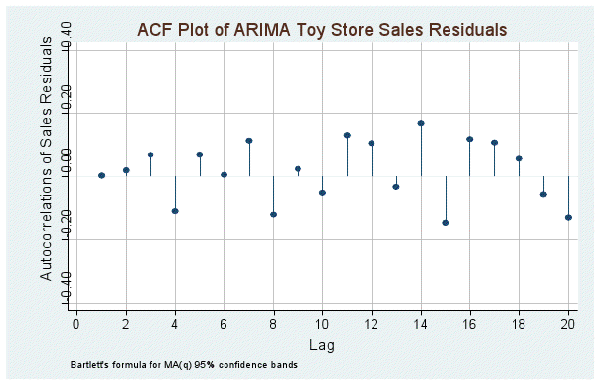

- Stationarity Analysis

- Unit Root – Dickey-Fuller Tests,

- Autocorrelation Function Analysis,

- Partial Autocorrelation Function Analysis.

- Spurious Regression, Co-integration & Granger Causality Tests

- Causal Regression Techniques

- Identification and integration of causal factors, such as leading and coincident indicators,

- Univariate Causal Models,

- Multivariate Causal Models,

- Linear time series regression,

- Transformations and Curve Fitting time series regression.

- Event Studies & Interrupted Time Series

- Multiple application of the above methods to improve appraisal reliability.