Econometric analysis is a broad scope term, which covers macro and micro econometric analysis as it relates to business and real estate valuation, financial modeling, and litigation. It involves the application of:

- statistical modeling techniques in the analysis of benchmark cross sectional and longitudinal data, i.e., data at a moment in time and data over longer periods of time;

- game theory as it applies to data quality and sampling in economics and business valuation; and

- time series analysis as it applies to forecasting benchmark data and an individual company’s data into the near and long term future.

The process of business and real estate valuation requires the analysis and interpretation of external economic and benchmark data against the internal company or property data of a subject under appraisement. The goal of this analysis is to apply techniques consistent with modern macro and microeconometric principals to arrive at an objective, unbiased valuation conclusion to aid business and property owners in the management of their assets.

Whether this data is external comparable or guideline companies, real estate comparables, local demographic and microeconomic data; or internal historical operating trends, cash flows, earnings, or capital requirements; it all requires objective analysis and interpretation. Objectively interpreting this data requires an advanced knowledge and application of finance and statistical and econometric modeling. The application of statistical and econometric methods is what brings science and objectivity to data analysis and valuation, and is what distinguishes mere biased, unsupported, naive and empty opinion from well informed useful, professional analysis and advice. In other words, paraphrasing an anonymous bumper sticker in the business of valuation as in most endeavors, “It is better to be informed than opinionated”.

Unfortunately, the vast majority of individuals and CPAs holding themselves out as appraisers have little if any training in statistical and econometric methods. What training these individuals and CPA appraisers receive is from unaccredited, privately held credentialing organizations which have no obligation to comply with any state education standards, and which either do not teach statistical finance and econometrics, or if they do so, teach these complex but necessary elements of valuation only at the most rudimentary and superficial levels. This superficial education then leads to misapplication and misrepresentation of statistical and econometric techniques and principals by these poorly trained appraisers. While one might speculate as to a range of reasons why these unaccredited, privately held credential mills do not teach these methods such as: conflicts of interest with the data they sell, conflicts with the sale of their vested ideological agendas which are designed to promote the sale of the data, or the dumbing down of sophisticated and complex topics for the purpose of gaining more members and member dues; suffice it to say that these unaccredited, credentialing organizations do not provide adequate education to their appraiser members, and consequently the many credentialed members promoting themselves on their organization’s credentials, are inadequate to the task of objective valuation research, data analysis, and development of unbiased valuation conclusions.

The courts have grown increasingly intolerant of ill-trained appraisers who, intentionally or unintentionally, distort data to promote some self-serving valuation opinion; who advocate for a client; or who, in lieu of the substance and logic of their work, stand on or emphasize what they believe to be the sanctity of their credentials or the sanctity of their compliance with the self-serving ethical guidelines issued by their unaccredited, privately held credentialing organizations. (To quote Samuel Johnson 1709-1784, “Integrity without knowledge is weak and useless, and knowledge without integrity is dangerous and dreadful.”) The courts see through such appraiser hyperbole as form over substance, and are demanding to see more scientific, quantitative and objective logic. Such logic can only be derived from and grounded in sound statistical and econometric modeling.

The principals at Accredited Business Appraisals have this statistical and econometric background, explicitly and implicitly employing these methods in all our appraisals. In so doing, we make every effort to remove any potential bias in our valuation and consulting work through the application of objective statistical and econometric methods. Although the principals at Accredited Business Appraisals currently hold or have held numerous credentials from these aforementioned privately held credentialing organizations, we place greater weight on our years of experience and the logic and substance of our analysis over the superficiality of some credential sold by one of these privately held, unregulated, for profit, credential mill organizations.

A short list of the statistical and econometric methods which we consider and may apply to any given appraisal includes but is not limited to:

- Sampling Theory, Survey Analysis and Proper Data Collection,

- Game Theory Concepts and Applications in Business and Econometrics

- Univariate, Bivariate and Multivariate Statistical Applications such as:

- Box Plots, Interval Plots and Identification of Interquartile Ranges,

- Simple Ordinary Least Squares Regression Analysis,

- Multiple Regression Analysis,

- Robust Regression Analysis such as:

- Iteratively Reweighted Least Squares

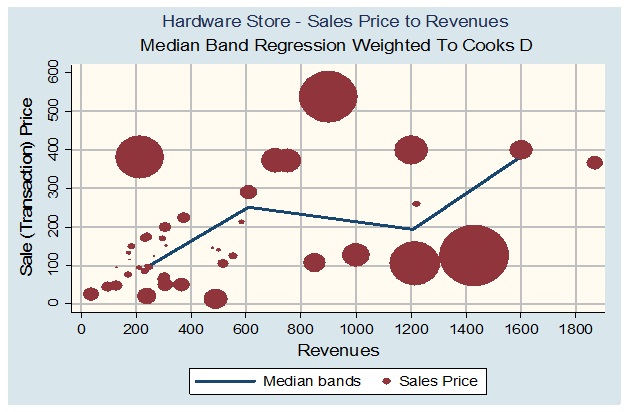

- Quantile and Median Regression.

- Instrument Variable Analysis,

- 2 Stage Least Squares for Measurement of:

- Supply and Demand and

- Probable Value and Price

- Pattern Recognition and Application of Piecewise Regression Techniques,

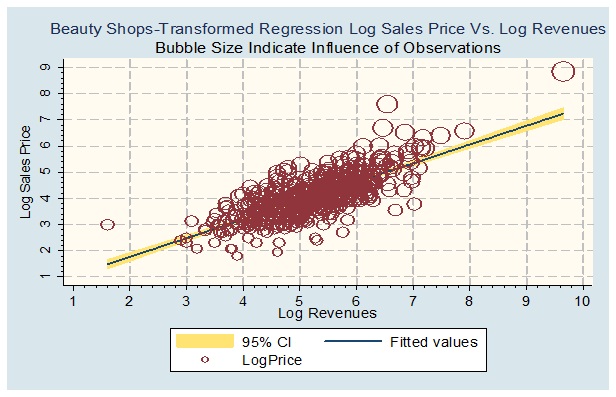

- Transformation and Curve Fitting,

- Application of Categorical Variables,

- Logistic & Probit Regression for Binary Response Variables,

- Wald Tests

- Likelihood Ratio Tests

- Homser & Lemeshow Tests

- Receiver Operating Characteristic Curves & AUC Interpretation

- Akaike Information Criterion

- Schwartz Bayesian Criterion

- Multiple Causal Regression procedures,

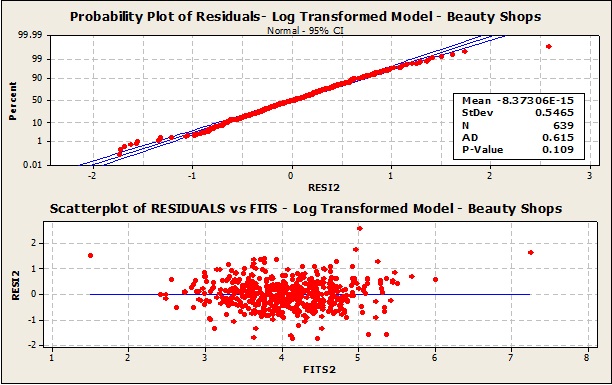

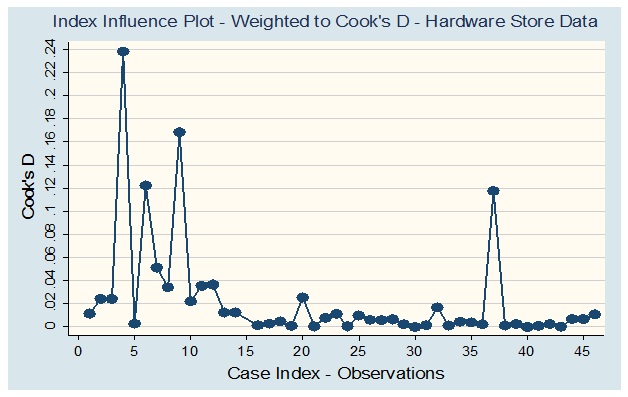

- Model checking for validation and compliance with required statistical assumptions such as:

- Symmetrical or normal, independent distributions,

- Correcting for multicollinearity,

- Correcting for omitted variable bias,

- Correcting for censored or truncated data.